Understanding Life Insurance Quotes in Pottawatomie County, OK

페이지 정보

본문

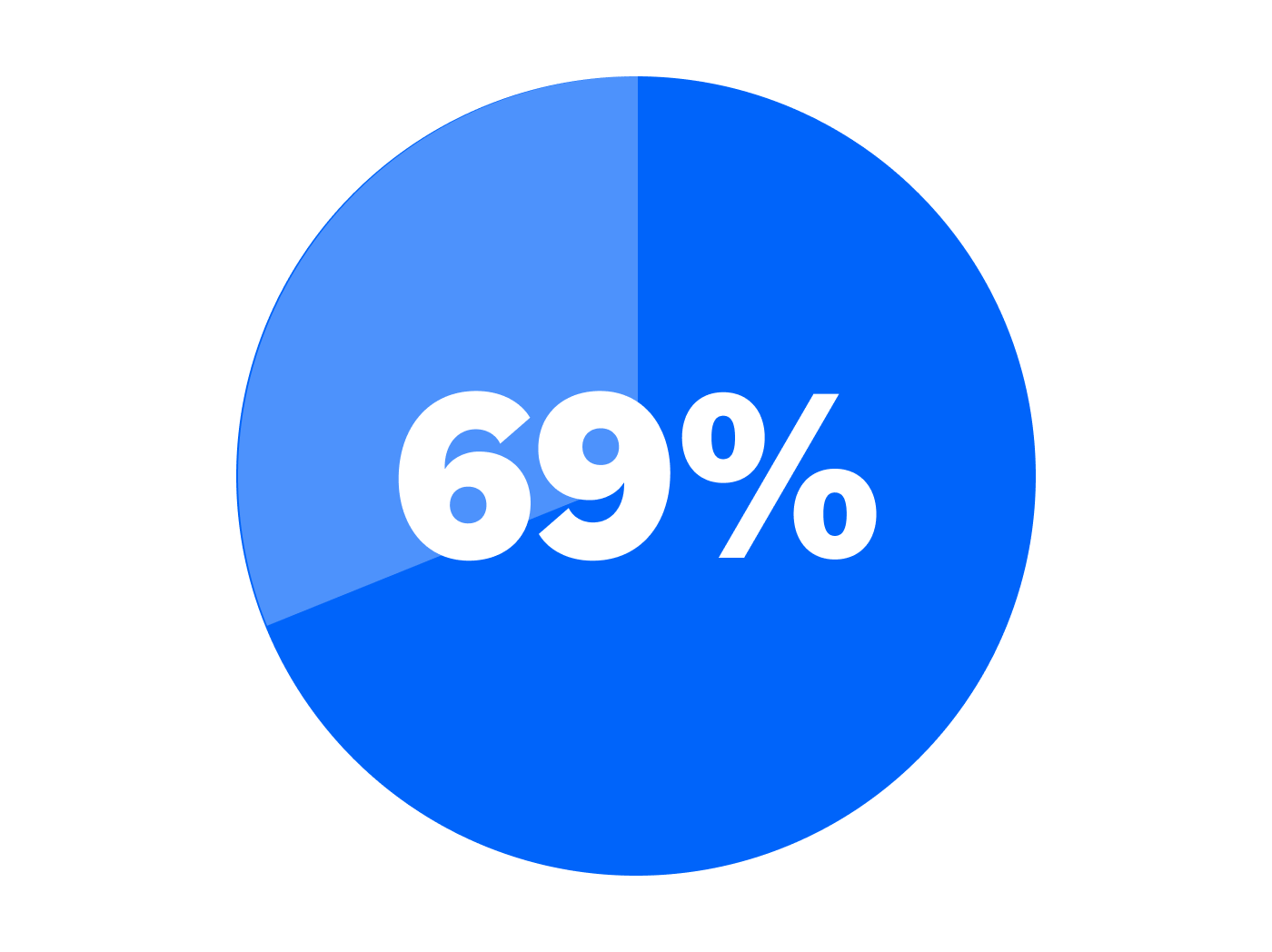

Life insurance is a crucial component of financial planning, providing peace of mind and Branded & Service-Specific (61–80) financial security for individuals and their families. In Pottawatomie County, Oklahoma, understanding life insurance quotes is essential for residents looking to protect their loved ones' future. This article explores the factors influencing life insurance quotes in Pottawatomie County and best life insurance Oklahoma offers insights into obtaining the best coverage.

Pottawatomie County, located in central Oklahoma, has a diverse population with varying life insurance needs. Life insurance quotes in this region are influenced by several factors, including age, health, lifestyle, and the type of policy chosen. Age is a significant determinant, as younger individuals generally receive lower premiums due to their lower risk profile. Health status also plays a crucial role; applicants with pre-existing conditions or a history of serious illnesses may face higher premiums or be required to undergo medical examinations.

Lifestyle choices, such as smoking, alcohol consumption, and participation in high-risk activities, can also impact life insurance quotes. For instance, smokers typically pay higher premiums due to the increased health risks associated with smoking. Additionally, the type of policy selected—whether term life, whole life, or universal life—affects the cost. Term life insurance, which provides coverage for a specified period, is generally more affordable than whole life or universal life policies, which offer lifelong coverage and cash value accumulation.

To obtain competitive life insurance quotes in Pottawatomie County, residents should consider several strategies. First, shopping around and comparing quotes from multiple insurance providers can help identify the best rates. Online comparison tools and working with independent insurance agents can streamline this process. Second, maintaining a healthy lifestyle and addressing any health issues can lead to lower premiums. Regular exercise, a balanced diet, and routine medical check-ups can improve overall health and reduce insurance costs.

Furthermore, understanding the coverage needs is essential. Assessing financial obligations, such as mortgage payments, outstanding debts, and future educational expenses for dependents, can help determine the appropriate amount of coverage. Over-insuring can lead to unnecessary expenses, while under-insuring may leave loved ones financially vulnerable.

In conclusion, life insurance quotes in Pottawatomie County are influenced by various factors, including age, health, lifestyle, [empty] and policy type. Residents can secure the best coverage by comparing quotes, maintaining a healthy lifestyle, and understanding their coverage needs. By taking these steps, individuals can ensure that their loved ones are financially protected, providing peace of mind and security for the future.

- 이전글έλεγχο κυβέρνηση πυρηνικό κατασκευές ιστοσελίδων Βόλος Ιαπωνία: Διαβεβαιώσεις από τις αρχές για τη διαρροή μολυσμένου ύδατος 25.06.20

- 다음글Μέρκελ Κρίση Πρωτογενές πλεόνασμα Σχολη Χορου Θεσσαλονικη Σε λαϊκή αντεπίθεση καλεί το ΚΚΕ 25.06.20

댓글목록

등록된 댓글이 없습니다.