Exploring the Advancements in Gold And Silver IRAs: A Complete Guide

페이지 정보

본문

In recent years, the panorama of retirement investing has seen important modifications, significantly within the realm of alternative belongings like gold and silver. As conventional funding avenues face volatility and uncertainty, many traders are turning to Gold and Silver Particular person Retirement Accounts (IRAs) as a hedge towards inflation and financial instability. This article delves into the demonstrable advances in Gold and Silver IRAs, highlighting their advantages, regulatory updates, and trusted gold ira investment firms the emerging developments which are shaping this investment space.

Understanding Gold and Silver IRAs

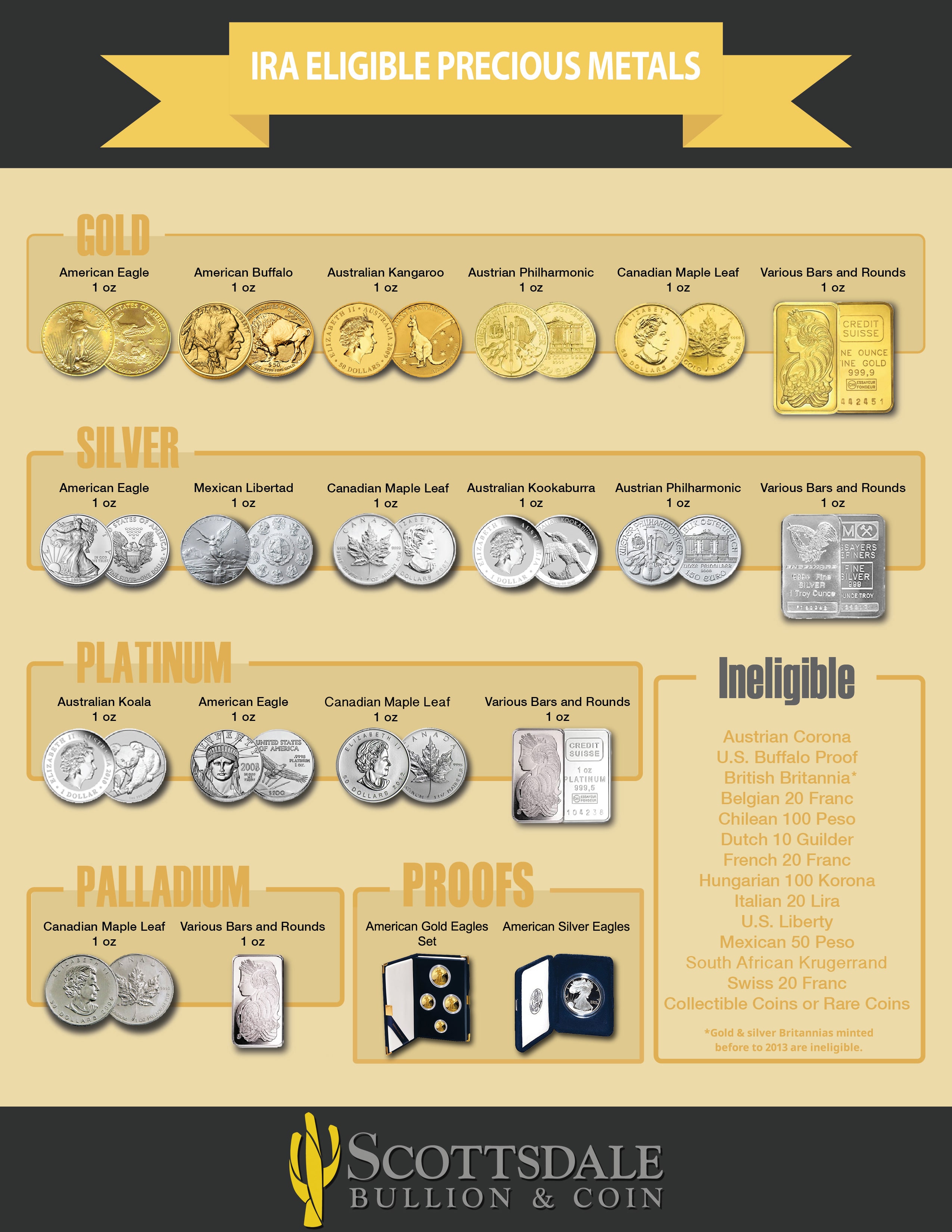

Gold and Silver IRAs are specialised retirement accounts that permit people to spend money on bodily treasured metals reasonably than traditional property like stocks and bonds. These accounts are designed to offer investors with a solution to diversify their portfolios and protect their wealth against market fluctuations. The IRS permits certain forms of valuable metals to be held in these accounts, together with gold bars, coins, silver bullion, and more, provided they meet specific purity requirements.

Recent Regulatory Adjustments

One of the most vital developments in Gold and Silver IRAs has been the evolving regulatory framework that governs these accounts. The IRS has made strides in clarifying the principles surrounding valuable metallic investments in retirement accounts. For example, the Tax Cuts and Jobs Act of 2017 allowed for greater flexibility within the types of assets that may very well be included in IRAs, leading to an increase in the recognition of Gold and Silver IRAs.

Moreover, the IRS has streamlined the process for reporting and compliance, making it easier for traders to manage their accounts. This readability has inspired more individuals to think about Gold and Silver IRAs as a viable option for retirement financial savings. Moreover, the IRS has carried out strict tips regarding the storage and safety of treasured metals, guaranteeing that traders can have peace of thoughts figuring out their property are protected.

Enhanced Entry to Treasured Metals

One other notable development within the Gold and Silver IRA market is the increased entry to treasured metals through varied monetary institutions. Prior to now, traders often faced challenges in finding reputable sellers and custodians for their Gold and Silver IRAs. Nonetheless, the rise of on-line platforms and specialized monetary services has made it simpler for people to spend money on these assets.

Many corporations now provide complete providers that embody account setup, metallic sourcing, and safe storage options. These advancements have created a extra user-friendly experience for buyers, allowing them to easily navigate the complexities of organising and managing a Gold or Silver IRA. Furthermore, the emergence of expertise has enabled traders to make transactions shortly and efficiently, often with just some clicks.

Educational Assets and Awareness

The growth of Gold and Silver IRAs has also been accompanied by a surge in instructional assets aimed at informing investors about the advantages and intricacies of these accounts. Many financial institutions and funding corporations now present webinars, articles, and guides that outline the benefits of investing in treasured metals for retirement.

This increased awareness has empowered traders to make informed selections about their retirement financial savings. As more individuals recognize the potential of Gold and Silver IRAs as a hedge in opposition to inflation and a technique of wealth preservation, the demand for these accounts continues to rise. Academic initiatives have additionally helped dispel common myths and misconceptions surrounding valuable metal investments, additional encouraging participation on this market.

Diversification and Danger Management

Certainly one of the primary causes traders are gravitating in the direction of Gold and Silver IRAs is the desire for diversification and threat administration. In an economic local weather characterized by uncertainty, conventional assets comparable to stocks and bonds will be extremely risky. Precious metals, however, have traditionally maintained their value throughout times of financial distress.

Latest studies have proven that including gold and silver to a retirement portfolio can considerably scale back overall risk while enhancing returns. This is especially related in the context of rising inflation and geopolitical tensions, which might adversely have an effect on conventional investments. As a result, more monetary advisors are recommending Gold and Silver IRAs as a strategic component of a nicely-rounded retirement plan.

The Rise of Self-Directed IRAs

The rise of self-directed IRAs has been a recreation-changer for buyers wanting to include gold and silver in their retirement portfolios. Self-directed IRAs give buyers higher management over their funding selections, permitting them to directly choose the treasured metals they wish to hold in their accounts. If you loved this post and you would like to acquire a lot more information concerning Trusted gold Ira investment Firms kindly pay a visit to our webpage. This flexibility has led to a surge in recognition for Trusted gold ira investment Firms Gold and Silver IRAs, as investors can tailor their portfolios to align with their particular person objectives and danger tolerance.

Moreover, self-directed IRAs typically come with lower fees compared to conventional IRAs, making them an attractive option for value-acutely aware investors. This shift in the direction of self-course has democratized access to treasured metals, empowering individuals to take cost of their retirement financial savings in a approach that was not beforehand attainable.

Improvements in Storage Solutions

The safety and storage of precious metals have at all times been a priority for investors. However, latest advancements in storage solutions have addressed these issues head-on. Many custodians now provide state-of-the-art storage facilities with superior security measures, together with 24/7 surveillance, insurance coverage, and safe entry protocols.

Additionally, some companies have introduced modern storage options, corresponding to allocated storage, where traders can have their specific metals saved in a segregated method. This ensures that traders have direct possession of their assets, providing an added layer of safety and peace of mind.

Conclusion

Because the investment landscape continues to evolve, Gold and Silver IRAs have emerged as a compelling choice for individuals searching for to safeguard their retirement savings. With developments in regulatory readability, access to treasured metals, academic assets, and modern storage solutions, these accounts are extra accessible and interesting than ever earlier than.

Traders are more and more recognizing the importance of diversification and threat management in their retirement portfolios, making Gold and Silver IRAs a beautiful choice. Because the demand for these accounts continues to develop, it is important for investors to remain knowledgeable about the latest developments and tendencies available in the market. By doing so, they could make effectively-knowledgeable choices that can help secure their monetary future in an unsure world.

- 이전글시알리스복제약, 레비트라 냄새 25.08.15

- 다음글Rapport D'Analyse Immobilière : Informations Pratique Par Les Vendeurs et Mécènes 25.08.15

댓글목록

등록된 댓글이 없습니다.