You can Thank Us Later - 3 Reasons To Stop Eager about Car Loan Financ…

페이지 정보

본문

Delving into Auto Finance: Navigating Affordable Choices

Delving into Auto Finance: Navigating Affordable ChoicesDefining Car Finance

Car finance refers to the different methods people use to acquire a vehicle, whether new or used. The financial tools available enable individuals to spread the cost of a vehicle over a period of time. There are various finance choices available, which can suit different needs and budgets.

Car finance refers to the different methods people use to acquire a vehicle, whether new or used. The financial tools available enable individuals to spread the cost of a vehicle over a period of time. There are various finance choices available, which can suit different needs and budgets.Understanding Car Loans

A car loan is a common way to finance your vehicle purchase. These loans are usually secured against the car itself, which implies that if you fail to repay the loan, the lender has the right to repossess the vehicle. Auto loans can be tailored for new or used vehicles, making them a flexible option for a lot of buyers.

Cheap Car Finance and Low-Cost Options

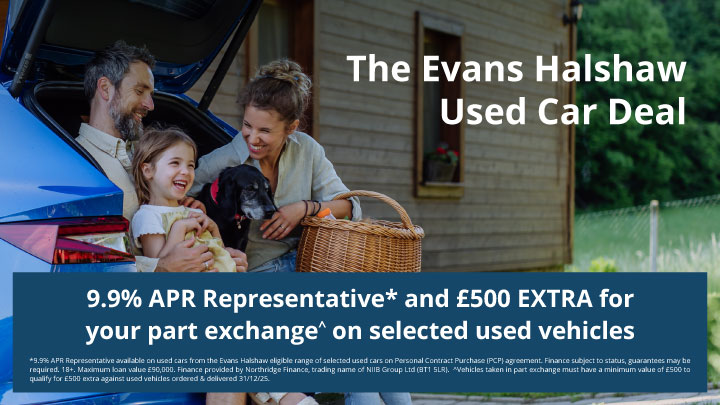

Finding cheap car finance options can save you a considerable amount of money. You may explore various finance providers that offer competitive rates. While seeking the best car finance deals, it's essential to compare the APR and choose what fits your financial situation.

Exploring Used Car Financing

When considering used car finance, there are specific things to keep in mind. Many lenders offer used auto financing at affordable rates, making it easier to own a vehicle without breaking the bank.

Advantages of Used Car Loans

Used car loans typically come with lower price tags compared to their new counterparts, meaning the amount you need to borrow is often less. This reduces monthly payments and lowers your overall financing costs. Additionally, many lenders provide competitive used car financing deals, making it more feasible for buyers.

Tips for Securing the Best Car Loan Rates

Securing the best interest rates is crucial for reducing payments over the life of your loan. To do this, evaluate your credit score, compare different lenders and consider applying for a loan before choosing your vehicle.

Using a Car Finance Broker

Car finance brokers can simplify your search for the best car finance. They can help you navigate various lending options, enabling you to find the right deal tailored to your needs.

Various Financing Avenues

Whether you're looking for cheap car finance or specific types of loans like classic car loans, understanding the myriad of available options is vital. From low interest car loans, the choice can make a significant difference in your purchasing experience.

What to Look for in Vehicle Finance Contracts

When you seek to secure a vehicle loan, you should carefully read all terms and conditions. Many contracts will include payment periods that can affect your overall cost. Keeping a keen eye on these aspects will help you identify the best car finance deals.

Securing Your Car Loan

The process to apply for auto financing is relatively straightforward. You should begin by provide personal information, credit history, and employment details. Lenders will use this information to determine your eligibility for cheap car loans.

What You Need to Apply for Car Finance

To start your car finance process, you'll generally need:

- A valid form of identification

- Proof of income (like pay slips or bank statements)

- Details of the vehicle you wish to purchase

Wrapping Up: Choosing the Best Car Finance

In summary, car finance provides a pathway to vehicle ownership for many with varying financial circumstances. From cheap car finance to options tailored for second hand cars, the world of car finance is extensive. Take the time to compare options, seek advice from a finance expert if necessary, and ensure you are making an informed decision. The right auto financing can lead to a successful and enjoyable vehicle ownership experience.

- 이전글비아그라효과일베 비아그라정품원액 25.09.09

- 다음글The Top Reasons Why People Succeed In The Buy Earphones Industry 25.09.09

댓글목록

등록된 댓글이 없습니다.