Audit‑Ready Tax Plans for Small Companies

페이지 정보

본문

Small businesses face a unique set of challenges when it comes to taxes.

Small businesses face a unique set of challenges when it comes to taxes.With limited resources, a single owner often wears many hats, and the risk of an audit can feel like a looming threat.

Using a few uncomplicated, audit‑proof approaches helps small firms diminish risk, keep finances tidy, and free up time for expansion.

KEEP ACCURATE AND ORGANIZED RECORDS

• Store receipts, invoices, and bank statements online in a secure, searchable format.

• Utilize cloud‑based bookkeeping software that auto‑tags expenses and outputs reports.

• Reconcile accounts on a monthly basis; any overlooked entry can invite IRS questions.

SEPARATE PERSONAL AND BUSINESS FINANCES

• Set up a separate business checking account and credit card.

• Never use business funds for personal expenses, and likewise avoid personal funds for business.

• Keep a transparent ledger that records the purpose of every transaction.

CLAIM ALL ELIGIBLE DEDUCTIONS

• Record mileage via a mileage log or an app that automatically tracks trips.

• Deduct home‑office costs only if a part of your home serves exclusively as a business space.

• Retain records for equipment, software, and travel costs—photos, receipts, and contracts are useful.

USE TAX‑ADVANTAGED ACCOUNTS

• Make contributions to a SEP‑IRA, Solo 401(k), or SIMPLE IRA to lower taxable income.

• Increase yearly contributions to fully leverage tax shelters.

• Store contribution records and statements for audit readiness.

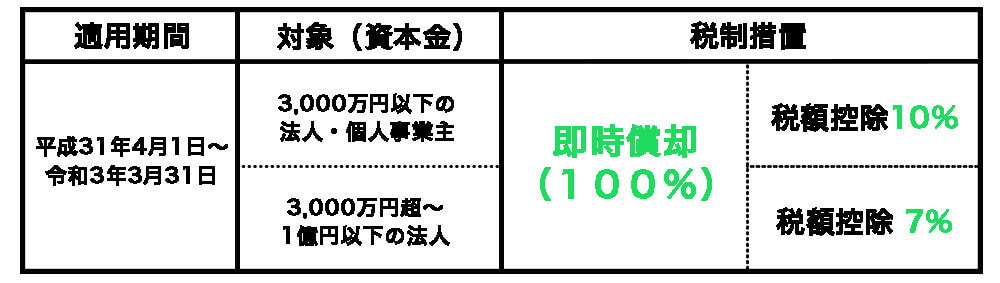

UNDERSTAND DEPRECIATION

• Select the proper depreciation method—Section 179, 期末 節税対策 bonus depreciation, or MACRS.

• Document the cost basis, useful life, and depreciation schedule.

• Re‑evaluate asset purchases to ensure you’re using the most tax‑efficient approach.

STAY CURRENT ON TAX LAW

• Subscribe to newsletters from reputable tax authorities or professional associations.

• Attend webinars or local workshops on tax updates for small businesses.

• Store a quick‑reference guide for major changes like new deduction limits or filing deadlines.

HIRE A PROFESSIONAL WHEN NEEDED

• A CPA or tax attorney can supply audit defense expertise.

• They review records, advise on more deductions, and support tax planning.

• Even a quarterly check‑in can uncover hidden risks before they become audit triggers.

CONDUCT INTERNAL AUDITS

• Plan quarterly reviews of expenses, payroll, and compliance documents.

• Employ a checklist to verify all required forms are filed and accurate.

• Resolve discrepancies right away instead of letting them compound.

KEEP DOCUMENTATION FOR AT LEAST SEVEN YEARS

• The IRS applies a seven‑year statute of limitations to most tax matters.

• Store copies of W‑2s, 1099s, receipts, and bank statements in a fire‑proof safe or secure cloud storage.

• Mark documents clearly by year and purpose to expedite any future review.

PLAN FOR THE FUTURE

• Project next year’s tax liability and make estimated quarterly payments.

• Review business structure—an LLC, S‑Corp, or sole proprietorship may offer different tax advantages.

• Schedule a tax‑planning session before key decisions like hiring, purchasing, or expanding.

Why Do These Strategies Matter?

Audits are more than catching mistakes; they allow a business to show responsible operation.

By maintaining clean records, separating finances, and staying informed, small firms can:

• Diminish the risk of an audit or at least make the process easier if it occurs.

• Uncover and correct errors before they turn into expensive penalties.

• Safeguard cash flow by preventing unforeseen tax liabilities.

• Build credibility with lenders, investors, and partners.

Final Thought

Time is money in the small‑business realm.

Applying these audit‑proof tax strategies doesn’t just protect you from the IRS—it frees you to focus on what you do best: growing your business.

Today, start tightening your record‑keeping, and let audit readiness bring peace of mind that propels your next big move.

- 이전글ΝΑΤΟ ΝΑΤΟ ΝΑΤΟ Digital Marketing Λίβανος: Δύο ισχυρές εκρήξεις με στόχο την πρεσβεία του Ιράν στη Βηρυτό 25.09.12

- 다음글레비트라 처방가격 레비트라 약 부작용 25.09.12

댓글목록

등록된 댓글이 없습니다.