Choosing Deductible Assets: Expert Guidance

페이지 정보

본문

In choosing capital allocation, the choice of deductible assets is one of the most powerful levers in a business’s tax strategy.

Opting for the correct combination of tangible and intangible assets enables tax savings, maintains liquidity, and promotes long‑term expansion.

Here follows a pragmatic guide, compiled from actual experience and contemporary tax statutes, aimed at guiding you toward the most valuable asset choices.

Why Asset Choice Matters

Each dollar placed in a deductible asset becomes available for other uses, such as scaling operations, reducing debt, or rewarding shareholders.

Tax law provides targeted incentives for particular asset classes, frequently through accelerated depreciation, bonus depreciation, or full expensing.

Mistakes can cause missed opportunities or penalties, underscoring the need for a well‑defined strategy.

1. Tangible Property: A Classic Deductible

• Section 179 – Immediate expensing of qualifying equipment and software under $1,080,000 (2024 limits; adjust annually). Suitable for machinery, office furniture, or computers.

• Bonus Depreciation – 100% for qualifying property placed in service before January 1, 2023; then tapered to 80%, 60%, 40%, 20%, and 0% across five years. Effective for new tech or vehicles.

• MACRS – Modified Accelerated Cost Recovery System offers a 5‑, 7‑ or 10‑year schedule for most tangible assets. It applies when Section 179 or bonus depreciation isn’t elected.

Expert Tip: Merge Section 179 with bonus depreciation when purchasing a high‑value vehicle (e.g., a delivery truck). The vehicle can be fully expensed up to $25,000 under Section 179, then bonus depreciation applies to the remaining basis.

2. Real Estate: Long‑Term Advantages

• Depreciation on commercial buildings is spread over 39 years (residential rental over 27.5). While slow, it provides a steady tax shield.

• Cost segregation studies can reclassify certain building components as 5‑, 7‑, or 15‑year property, accelerating depreciation.

• 1031 Exchanges allow you to defer gains by reinvesting in like‑kind property, preserving capital for future growth.

Expert Tip: If you’re leasing out space, consider a 1031 exchange after five years to swap into a higher‑yield property. The additional depreciation can offset the deferred gain, improving cash flow.

3. Intangible Assets: Less Obvious but High Impact

• Research & Development (R&D) Credits – Up to 20% of qualified costs, with carryforwards and carrybacks.

• Section 199 – The Qualified Business Income deduction permits up to 20% deduction for specific pass‑through entities.

• Goodwill and acquired intangible assets – amortized over 15 years, providing an annual deduction.

Expert Tip: Track R&D expenses meticulously. Even small software updates can qualify. Claiming the credit early can reduce the need for other deductions later.

4. Software & Intellectual Property

• Software bought for business purposes may be expensed under Section 179 when it satisfies the "qualifying property" definition.

• New software development costs may be capitalized and amortized over five years via ASC 350, with quarterly deductions.

• Licensing contracts can be arranged as operating leases, permitting lease payments to be counted as operating expenses.

Expert Tip: For SaaS businesses, consider subscription fees as operating expenses, not capitalized. This keeps the balance sheet thin and maximizes current deductions.

5. Renewable Energy Incentives

• Investment Tax Credit (ITC) – 26% for solar projects (decreases to 22% in 2023, then phased out).

• Production Tax Credit (PTC) – Relevant for wind and other renewable initiatives.

• Accelerated Depreciation – Renewable energy equipment can be eligible for bonus depreciation, commonly combined with the ITC.

Expert Tip: Adding solar panels to a corporate campus allows pairing the ITC with bonus depreciation on the equipment. The combined benefit may surpass the initial cost in the first year.

6. Vehicles: A Special Case

• Section 179 limits for vehicles are capped ($25,000 for passenger vehicles, $33,000 for trucks, vans, SUVs).

• Luxury vehicle depreciation limits apply; exceeding them may require the standard MACRS schedule.

• The choice between lease and purchase influences deductibility: lease payments are entirely deductible as operating expenses.

Expert Tip: Delivery fleets may benefit from leasing instead of purchasing. Lease payments are fully deductible and sidestep depreciation recapture risks upon sale.

7. Tax‑Deferred Retirement Plans

• Contributions to 401(k), SEP IRA, or SIMPLE IRA reduce taxable income directly.

• Employer contributions can be deducted as a business expense.

• Long‑term, these plans also boost employee retention and satisfaction.

Expert Tip: Max out the employer match and encourage employee contributions. The combined effect reduces current tax liability while building future wealth for both parties.

8. Timing and Strategic Planning

• Bunching Expenses – Consolidate deductible expenses into one year to move into a higher bracket if a lower bracket is expected next year.

• Deferring Income – Delay invoicing or billing to retain income in a lower‑tax year.

• Capital vs. Operating – Decide if an expense merits capitalization for long‑term depreciation or immediate expensing for instant deduction.

Expert Tip: Partner with a tax professional to develop a "tax calendar" that matches significant purchases with projected income changes. This proactive strategy can reduce your tax bill by thousands.

Common Pitfalls

• Misclassifying assets: Treating intangible costs as tangible can trigger audit scrutiny.

• Overlooking limits: Surpassing Section 179 caps may lead to partial deductions or a switch to MACRS.

• Ignoring state incentives: Some states match federal bonus depreciation or offer their own credits.

• Neglecting documentation: Maintain thorough receipts, depreciation schedules, and audit trails for all purchases.

Final Thoughts

Choosing the right deductible assets is more than a bookkeeping exercise; it’s a strategic decision that can unlock significant tax savings and fuel growth.

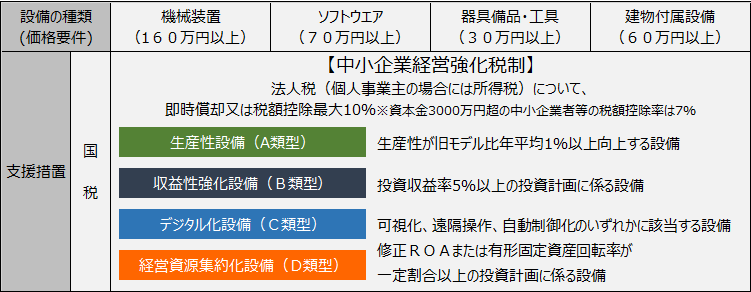

By leveraging Section 179, bonus depreciation, real estate strategies, 中小企業経営強化税制 商品 intangible credits, renewable incentives, and thoughtful timing, you can shape a tax profile that aligns with your business goals.

Always pair these strategies with diligent record‑keeping and professional guidance, and you’ll keep the tax code working for you rather than against you.

- 이전글Ελλάδα πληθωρισμός Ελλάδα δικηγοροι διαζυγιων - Οικονομία - Μείωση της ανεργίας στην ευρωζώνη στο 12,1% 25.09.13

- 다음글The Best Popular Casino Table Games Demystified 25.09.13

댓글목록

등록된 댓글이 없습니다.