A Information To Shariah-compliant Islamic Mortgage

페이지 정보

본문

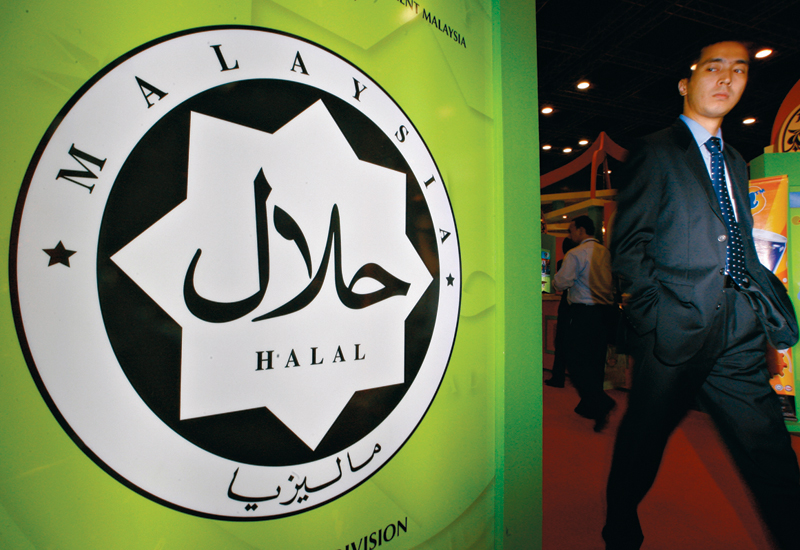

These offer meal kits with pre-measured components for straightforward mixing and cooking. And you presumably can customize these recipes by adding or substituting elements to meet halal standards. For the three solutions above to be accomplished right, the Islamic finance company needs to effectively purchase the house, own it, after which transfer its ownership to the homebuyers.

On-line Banking

The financial institution does not cost interest, as this isn't allowed in Islamic finance, but as a substitute expenses rent on the part of the property that the shopper doesn’t but own. The buyer also pays an additional quantity every month to progressively purchase the bank’s share of the property over a set interval. Under the Murabaha no-interest purchase plan, your sharia-compliant supplier buys the property and sells it to you at a marked-up value, which you pay in monthly installments.

- You can calculate the rent payments and, rent and acquisition payments you'll pay on the quantity of debt that you are taking.

- HelloFresh offers a vast menu with diverse options, nevertheless it doesn’t particularly cater to the strictest of halal diets because the meat isn’t licensed.

- You’ll find its recipes cheaper compared to lots of its opponents.

- When placing an order, you can select between 2 meals for 2 individuals and 6 recipes for 6 people.

- The major benefit of using Islamic finance providers is that it replaces the interest component with "rent".

Sharia Compliant Halal Mortgage Loans

The % of the property owned by every party is set by every side’s funding in the beginning. This product presents an various choice to standard mortgages for many who want to purchase their home to reside in, switch their mortgage or launch some fairness for different needs in a shariah compliant manner. Dubai Islamic Bank provides Shariah-compliant mortgages and tons of different kinds of loans.

After you make a proposal on a house and your contract has been accepted by the seller, you will want to finish your software for financing that particular property. If you might have already been Pre-Approved, a lot of the work may have already been carried out. Should you have any concerns concerning exactly where as well as how you can make use of sharia compliant, you possibly can email us at our page. The largest pro of living in a rental is having the liberty to move everytime you want.

Often the lower the FTV, the less your own home purchase plan will value you. For instance, if a home purchase plan has a maximum FTV of 80%, you’ll want a 20% deposit. For example, the house you buy may be valued at £250,000, however the bank might promote the property to you for £300,000.

- 이전글타짱맞고 게임하기 아이폰도 가능해요. :: dali 24.07.26

- 다음글doofootball.asia: ศูนย์รวมการถ่ายทอดสดฟุตบอลระดับโลก 24.07.26

댓글목록

등록된 댓글이 없습니다.